Why did we start Productfy?

Here’s a hint: it’s right there in the name.

Productfy was created to change the way financial products are built. By making it easier for FinTech entrepreneurs to bring their ideas to reality, we’re not just helping to make financial apps easier and user-friendly. If we democratize financial services, making it available at lower costs, it all can help people build credit and achieve financial

stability. And that can change the world.

The “a-ha” moment came when we saw a convergence of two macro trends. The first was that people were getting more and more comfortable with delegating large parts of their businesses to third-party vendors, such as Amazon Web Services. The second was the commoditization and digitization of financial services.

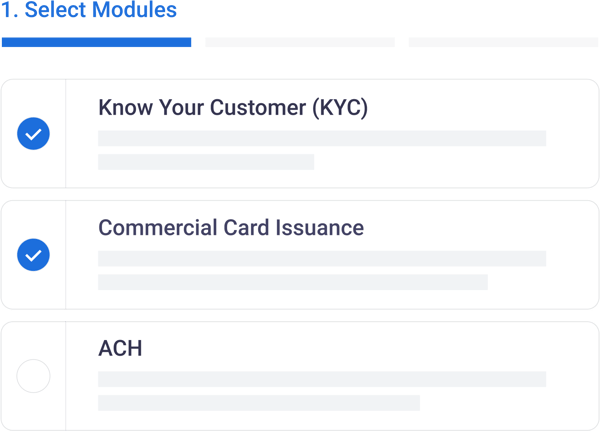

But there are a lot of hurdles to building a financial services technology product. You have to have the servers, a database, deposit accounts, KYC, credit profiles — and it can take years to get all of that done.

How do we know that? Because we’ve been there.

We understand the challenge and created a comprehensive, unified solution - complete with an elastic banking infrastructure, powered by a flexible general ledger, and skinned for an ‘App Store-like’ experience. We’re developers and builders ourselves and cut our teeth in product engineering and operations in FinTech and InsurTech, and bring a wealth of experience in compliance for regulated industries.

Productfy enables FinTechs to get to market quickly by providing the backend infrastructure, program management, compliance rails, and strategic partners necessary to build a world-class experience.

Productfy enables FinTechs to get to market quickly by providing the backend infrastructure, program management, compliance rails, and strategic partners necessary to build a world-class experience.

We’ve invested in building deep strategic relationships with providers up-and-down the financial ecosystem—sponsor banks, card issuers and fulfillment partners, financial data aggregators, credit bureaus, regulatory and compliance experts, and more.

Unified Money Movement

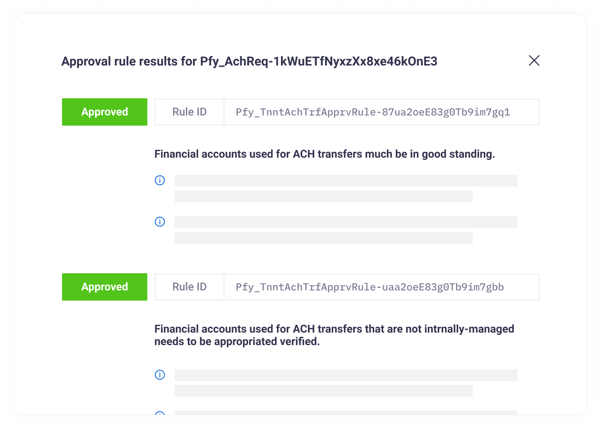

Our platform unifies features like account linking (IAV), data aggregation, managed KYC, and ACH into a single transaction and data stream to enable a streamlined money movement solution.

Digital Banking Made Simple

With a streamlined money movement solution, digital banking apps can be built on top easily. Digital wallets, FBO or Omnibus-type accounts powered by Productfy’s subledgering capabilities, and other types of accounts can be structured to your program.

Card Issuance Unlocked

Our strategic relationship with our bank partners and Marqeta for card issuance allows FinTechs to build, test, and deploy innovative debit and credit card and reward programs. For more information on how you can qualify to be an early partner in our ecosystem, please contact us.

Our best customers share our mission: to truly democratize access to millions of Americans who have traditionally been left out of or underserved by the financial system. It’s who we are, and it’s what we aspire to do. It’s the reason we have worked so many late hours to bring Productfy to life. We believe embedded FinTech has the potential to help reduce the tremendous wealth gap and give the most vulnerable among us to thrive. And this is the moment in history when we feel we can make a significant difference.

Are you on board?